How this two-time Olympian and his military partner help startups unlock big government contracts

Harpoon Ventures opens San Diego operation with fresh $120M to invest in upstart companies that focus on tech that’s important to the U.S.

San Diego has a long history as military town, and a burgeoning reputation as technology town, especially for startups.

That combination recently lured Harpoon Ventures — armed with a fresh $120 million to invest — to plant roots here.

Founded in 2018 in Menlo Park, Harpoon recently opened its main office in downtown San Diego overlooking Petco Park. The venture fund specializes in backing early stage technologies that have applications both in commercial markets and with the U.S. government.

Last month, it raised its third and largest startup fund with support from pension systems, endowments and well-known Silicon Valley venture investors such as a16z, formerly Andreessen Horowitz.

“Our thesis is to be commercial first,” said co-founder Larsen Jensen. “But our nuance is that big tech companies today got their start, in many ways, with government contracts and government deals. Oracle is one. Qualcomm had a lot of government support as well. That is what we’re trying to help modern-day enterprise companies harness as part of our strategy.”

Jensen is a former Navy SEAL and two-time Olympian, earning silver and bronze medals in swimming. He worked at Andreessen Horowitz and Lightspeed, earning an MBA along the way, before launching Harpoon with former U.S. Marine Corps officer William Allen.

After leaving the Marines, Allen earned a graduate degree at Columbia University and worked at consulting giant Deloitte on national security issues before branching into technology and finance.

“We think San Diego is very well-positioned from a cross-over, federally focused fund perspective,” said Allen. “That is why we chose San Diego. There is not that much education that we have to do for tech people or for military people here in town.”

Harpoon’s first fund after spinning out of Lightspeed in 2018 was small — just $3 million spread across 10 early stage companies.

But it established Harpoon’s credentials for delivering millions of government dollars to information technology startups.

“It generally takes a company 18 months to win their first federal deal,” said Jensen. “We have been, on average, about 75 percent faster than that. Since forming Harpoon about three years, we have helped our companies close $496 million in government deals.”

Harpoon typically is a co-investor alongside larger, pedigreed venture capitalists such as Sequoia Capital, Andreessen Horowitz, Benchmark and GV, formerly Google Ventures.

In 2019, Harpoon raised a second, $60 million fund, investing in 20 companies. It usually doesn’t target pure defense tech firms. “It’s actually the exact opposite,” said Allen. “We invest in stuff like business-to-business enterprise software that’s here in California, and then we find a place where (the technology) might fit in the federal government.”

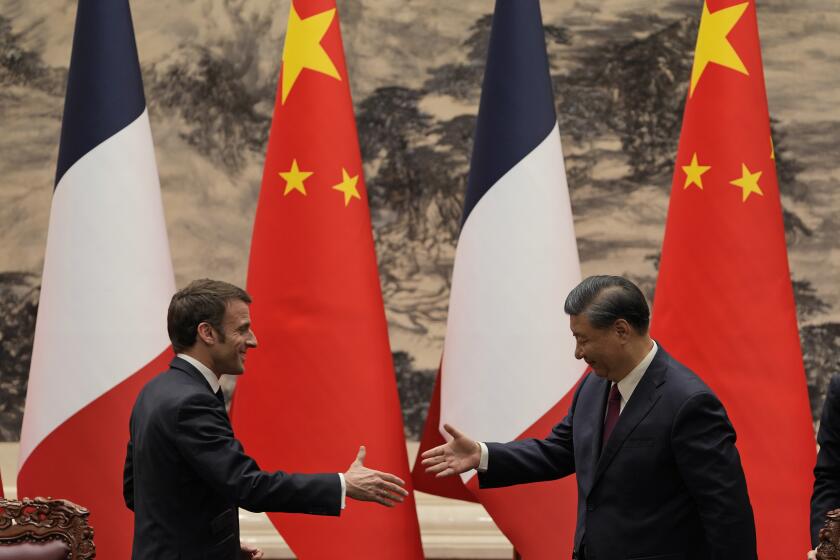

Still, Harpoon is focused broadly on technologies that are geopolitically important to the U.S. given the rise of China and other “near-peer” competitors.

That includes fields such as artificial intelligence, robotics, quantum computing, space tech, cyberinfrastructure, facial recognition, 3-D printing and drones, among others.

To date, Harpoon has put money into five companies from its new $120 million fund. Investment thresholds typically run from $500,000 to $5 million — essentially seed through Series B rounds.

Harpoon expects to maintain its strategy of co-investing alongside Blueblood venture capitalists — serving as the go-to federal procurement experts.

And they believe San Diego is a good place to execute that strategy.

“Now that we are here in San Diego, we are able to curate a conversation between these two worlds,” said Allen. “Government people come to San Diego constantly. And so do tech folks, like Qualcomm and many others that are coming down from the Silicon Valley with the rise of talent. So, we think we are very well-positioned.”

Get U-T Business in your inbox on Mondays

Get ready for your week with the week’s top business stories from San Diego and California, in your inbox Monday mornings.

You may occasionally receive promotional content from the San Diego Union-Tribune.